July 24, 2025

By Cory McPherson

July 2025

The stock market has continued its upward trend over the last month as the S&P 500 has reached all-time highs. It amazes me the extreme shift in sentiment in such a short amount of time going back just over 3 months. In this newsletter I’ll highlight some continued divergences with market momentum and the complacency shown and also touch on some of the changes coming with the recent bill passage in Washington.

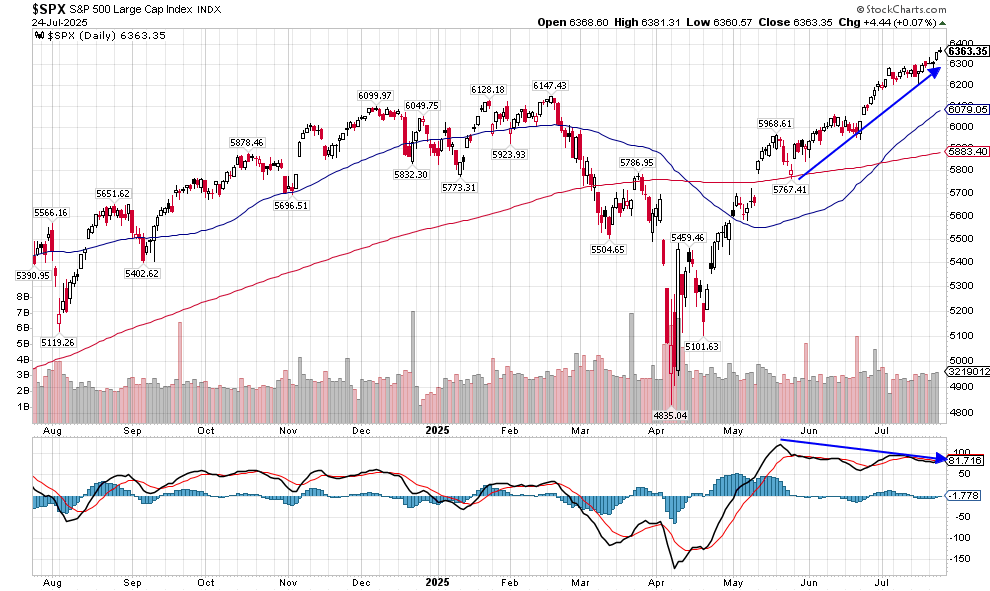

My last newsletter highlighted the divergence in price in the S&P 500 with one of its momentums indicators (MACD) and the chart below highlights how that has continued. Price continues to go up while its momentum indicator has been trending lower for 2 months. Divergences can last for a while, so it’s not calling for an imminent breakdown, but these typically precede some sort of drop in the market. This won’t continue up forever and the higher it stretches without any pullback, the more dangerous it can become. A drop into support is still something I’d like to see and can set up an eventual continued march higher. Of course, it’s possible we continue to march higher without any pullback, but history shows the higher it stretches like that, the worse the end result will be. We’re in the heart of quarterly earnings season, with many companies reporting their quarterly results over the next couple of weeks. We’re also approaching a seasonally weaker period typically for the stock market in August and September. It doesn’t mean something has to happen, but past corrections have occurred during this time period including just last year in late July/early August.

As the stock market has stretched higher, there are signs of complacency being etched into the market. Investors begin to believe that this thing can only go up and forget what has happened in the past. There are different sentiment readings that show this as investors become more and more bullish. We’re also starting to see a return of “meme stock” mania. In 2021 this is what led to the rapid rise in stocks like Game Stop and AMC Theaters. Now it’s showing in stocks from companies like Kohl’s, Krispy Kreme Donuts, and Opendoor Technologies. These are stocks that have been trending down for the last few years, and in some cases, going down to just a few bucks a share. An example is shown below with Kohl’s, going back 3 years on its share price. These stocks have a high percentage of their shares being shorted, and in most cases for good reason as their businesses have struggled. Retail trading message boards push these stocks to try and drive the price higher making a quick profit and hurting the big institutions on Wall Street that are shorting these stocks. They become very volatile and for those that jump in too late, can cause a lot of pain. To me, this is just another sign of high-risk appetite and speculative nature that typically happens before some sort of top in the market.

Taking a look at gold, with the chart below of the exchange-traded fund (ETF) GLD that tracks the price of gold, you can see the uptrend has continued. This despite the last 3 months being a period of consolidation. This chart continues to look positive to me as sideways action like this at a high level typically leads to a resumption of the prior trend. I don’t view this as positive or negative for the stock market and economy, I just view gold as its own asset that doesn’t correlate to anything for an extended period of time. While this consolidation can continue and even reach lower and still be viewed positively, its momentum indicator has been starting to turn up, making it appear that gold may be ready to break out to the upside.

With the recent passage of the “Big Beautiful Bill” (OBBBA) in Congress earlier this month, I wanted to highlight some of the areas that may impact you. At its core, it makes permanent many of the provisions from the original Tax Cuts and Jobs Act that went into effect in 2018. The tax rates and increased standard deduction from that bill were made permanent and it also increased the standard deduction for 2025.

There was speculation of changes to taxes on Social Security at the federal level, but that did not happen. What this bill does is create a temporary increase in the standard deduction for those age 65+ from 2025 through 2028. It is set at an additional $6,000 for single or $12,000 for joint filers where both spouses are 65+. The deduction begins to phase out though for those with an income level over $75,000 (single) and $150,000 (joint). It completely phases out for those with an income over $175,000 (single) and $250,000 (joint).

The bill also created new tax breaks, including eliminating taxes on tips up to $25,000/year for individuals making less than $150,000. That tax break expires in 2029. It also eliminates taxes on overtime pay up to $12,500/year for an individual making under $150,000. That also expires in 2029. Taxpayers can also now deduct interest on auto loans that are used to buy American-made cars, up to $10,000/year. This new deduction can be taken in addition to the standard deduction.

Overall, like most bills, there’s some good and some bad. The main thing for most people is this made permanent the current tax rates that were set to expire at the end of this year and would have become higher for most households if nothing was done. This at least provides clarity moving forward. Also, like most bills recently, this will add to the deficit over time. The government continues to spend at unsustainable levels that will eventually matter. Do they cut spending in a meaningful way in a separate bill? It’s possible and would offset some of the tax cuts but even the smallest of spending cuts have already been met with a fight.

We hope everyone is enjoying their summer and able to spend time with family and friends as this year continues to fly by. As always, reach out with any questions or concerns.

Cory McPherson is a financial planner and advisor, and President and CEO for ProActive Capital Management, Inc. He is a graduate of Kansas State University with a Bachelor of Science in Business Finance. Cory received his Retirement Income Certified Professional (RICP®) designation from The American College of Financial Services in 2017.

DISCLOSURE

ProActive Capital Management, Inc. (PCM”) is registered with the Securities and Exchange Commission. Such registration does not imply a certain level of skill or training.

The information or position herein may change from time to time without notice, and PCM has no obligation to update this material. The information herein has been provided for illustrative and informational purposes only and is not intended to serve as investment advice or as a recommendation for the purchase or sale of any security. The information herein is not specific to any individual's personal circumstances.

PCM does not provide tax or legal advice. To the extent that any material herein concerns tax or legal matters, such information is not intended to be solely relied upon nor used for the purpose of making tax and/or legal decisions without first seeking independent advice from a tax and/or legal professional.

All investments involve risk, including loss of principal invested. Past performance does not guarantee future performance. This commentary is prepared only for clients whose accounts are managed by our tactical management team at PCM. No strategy can guarantee a profit.

All investment strategies involve risk, including the risk of principal loss.

This commentary is designed to enhance our lines of communication and to provide you with timely, interesting, and thought-provoking information. You are invited and encouraged to respond with any questions or concerns you may have about your investments or just to keep us informed if your goals and objectives change.