October 31, 2025

By Cory McPherson

October 2025

Troubling signs have continued to appear throughout this year on consumer debt. Automobile loans have been one of the main areas displaying the most stress lately. Recent delinquency and repossession numbers have been on the rise. We’ve also seen some recent bankruptcy filings related to subprime auto lending. In this newsletter, we’ll take a look at some of these troubling signs and how it may affect the economy going forward.

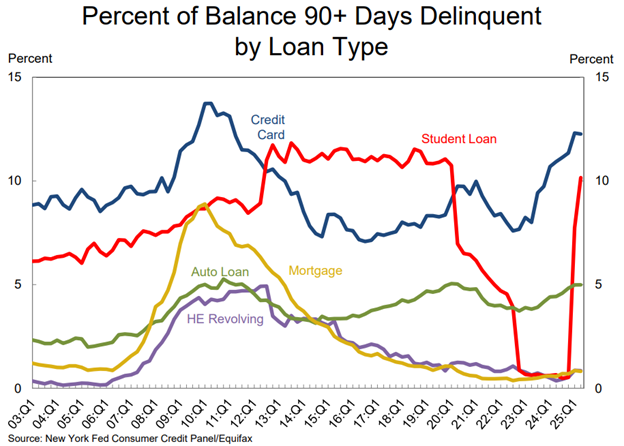

I’ve highlighted the chart below on percentage of balances 90+ days delinquent by different loan types in previous newsletters. This is the most updated chart from the New York Fed from August. You can see over the last year the percentage of loans becoming 90+ days delinquent has continued to rise in credit cards and auto loans. Though from its previous report the percentage has stabilized somewhat. The student loan percentage of course has skyrocketed this year as the moratorium on reporting of missed payments to credit agencies ended. Auto loan delinquencies remain near levels seen in 2008-2009 and credit card delinquencies still below but not far from levels seen in 2008-2009. Ideally, these continue to stabilize and begin to trend down. A slowdown in the economy and recession would most likely force these numbers much higher, going well past what was seen during the great recession time period.

In looking at auto loans, car payments have become for some household’s one of, if not the biggest monthly expense. The average price paid for a new vehicle topped $50,000 recently for the first time ever. It is estimated that over 19% of all financed new-car transactions have a monthly payment of $1,000 or more, with the average monthly payment on an auto loan being $767. The average loan amount has increased by 57% over the last 15 years, which is a bigger jump than any other loan category. Obviously the price of cars, both new and used has climbed substantially in the last few years and so has the average interest rates on auto loans. The average auto loan rate from data in September was 7% for new cars and almost 11% for used cars. In total, Americans owe over $1.6 trillion in automobile debt. Higher costs have also led to longer loan terms from some lenders, which ultimately increases the overall cost.

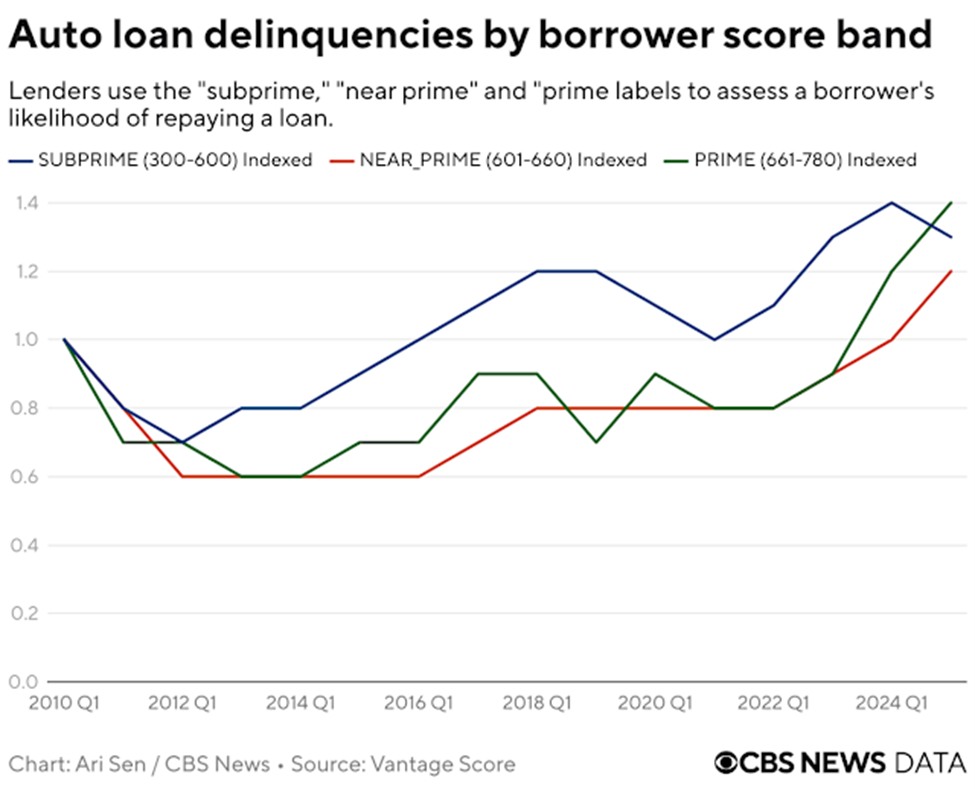

While it is expected that “sub-prime” borrowers (those with lower credit scores/income) would be the area seeing rising delinquencies, it has actually recently been shown across all borrowers, even those labeled “prime” or “near-prime” as the chart below shows. The prime and near-prime groups have actually seen a bigger increase in delinquencies over the last year.

Of course, with delinquencies, comes increased repossessions of vehicles. According to data from the Recovery Database Network (RDN), there have been over 7.5 million repossession assignments so far this year. These are authorizations given to an agency to recover a vehicle on behalf of a lender. An assignment doesn’t equal a repossession though as all aren’t successful and recovery ratios have fallen in recent years. Despite that, it is estimated that over 3 million cars could be repossessed this year, a number not seen since 2009 during the depths of the great recession.

As people struggle with monthly expenses and fall behind on monthly payments, this affects the companies that loaned the money as they can’t get paid back. Over the past month we’ve seen some bankruptcy filings from those associated with auto lending and more specifically sub-prime auto lending. Last month, a company called Tricolor filed for chapter 7 bankruptcy. Tricolor was in the business of subprime lending, offering terms to those with low income and bad credit scores. It was disclosed earlier in the year that actually 68% of its borrowers had no credit score at all. There are reports of some fraudulent activity in the company as they’re now being investigated. This did cause losses for some well-known banks including JPMorgan, Barclays, and Fifth Third Bancorp. JPMorgan reported a charge-off of $170 million from the Tricolor bankruptcy and their CEO Jamie Dimon warned this event may be a sign of a broader issue in the auto credit market. There have been a few other recent bankruptcy filings related to the auto industry and auto lending that have continued to raise concerns.

As I’ve discussed before, the biggest concern with this is that it’s happening in what’s supposed to be an expanding economy. An eventual recession with a spike in unemployment just exacerbates the trouble for those with large household debt that are already struggling to get by. And it appears that group is growing larger. While economic data from the government has been limited during this government shutdown, it will continue to be important to follow the labor market numbers when they do start releasing data again.

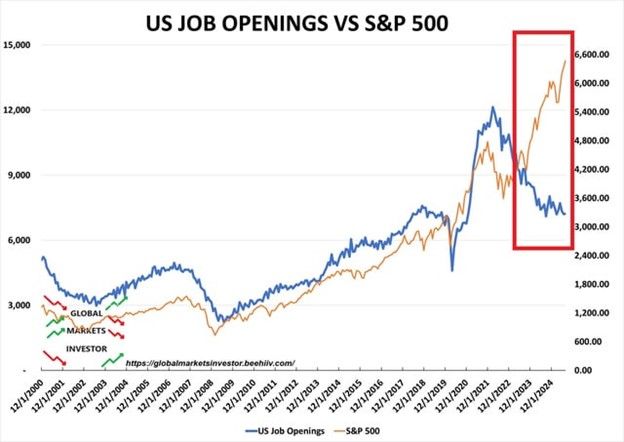

Despite the fact that many things appear to be cracking, the stock market has continued its rise and should end the month of October positive. It is also entering a period of historical positive returns here at the end of the year. While the market is stretched and well above some of its long-term moving averages, it doesn’t mean it can’t continue. With that though, a chart that caught my eye recently is the S&P 500 along with total reported nonfarm job openings. Historically the number of job openings has trended higher over time along with the stock market. When job openings have declined over a period of time it has coincided with a recession. Which then of course coincides with the stock market coming down. So, the two have been positively correlated historically. Since 2022 that has not been the case and is shown in the chart below.

Job openings boomed after the pandemic as companies were struggling to find enough workers. However, since 2022 the number of job openings has continuously been trending down. While the stock market had a period of weakness in 2022, since the end of that year it has trended up and diverged with what the number of job openings has done. Is this another economic indicator that’s been broken? The surge in AI spending and rapid market cap increase in the mega-cap technology stocks are a big reason for the market’s climb while the underlying economy has weakened. The question going forward is- can that continue and for how long?

Cory McPherson is a financial planner and advisor, and President and CEO for ProActive Capital Management, Inc. He is a graduate of Kansas State University with a Bachelor of Science in Business Finance. Cory received his Retirement Income Certified Professional (RICP®) designation from The American College of Financial Services in 2017.

DISCLOSURE

ProActive Capital Management, Inc. (PCM”) is registered with the Securities and Exchange Commission. Such registration does not imply a certain level of skill or training.

The information or position herein may change from time to time without notice, and PCM has no obligation to update this material. The information herein has been provided for illustrative and informational purposes only and is not intended to serve as investment advice or as a recommendation for the purchase or sale of any security. The information herein is not specific to any individual's personal circumstances.

PCM does not provide tax or legal advice. To the extent that any material herein concerns tax or legal matters, such information is not intended to be solely relied upon nor used for the purpose of making tax and/or legal decisions without first seeking independent advice from a tax and/or legal professional.

All investments involve risk, including loss of principal invested. Past performance does not guarantee future performance. This commentary is prepared only for clients whose accounts are managed by our tactical management team at PCM. No strategy can guarantee a profit.

All investment strategies involve risk, including the risk of principal loss.

This commentary is designed to enhance our lines of communication and to provide you with timely, interesting, and thought-provoking information. You are invited and encouraged to respond with any questions or concerns you may have about your investments or just to keep us informed if your goals and objectives change.